Skip Navigation

Business Checking

Think Small Business with...

Think Small Business with...

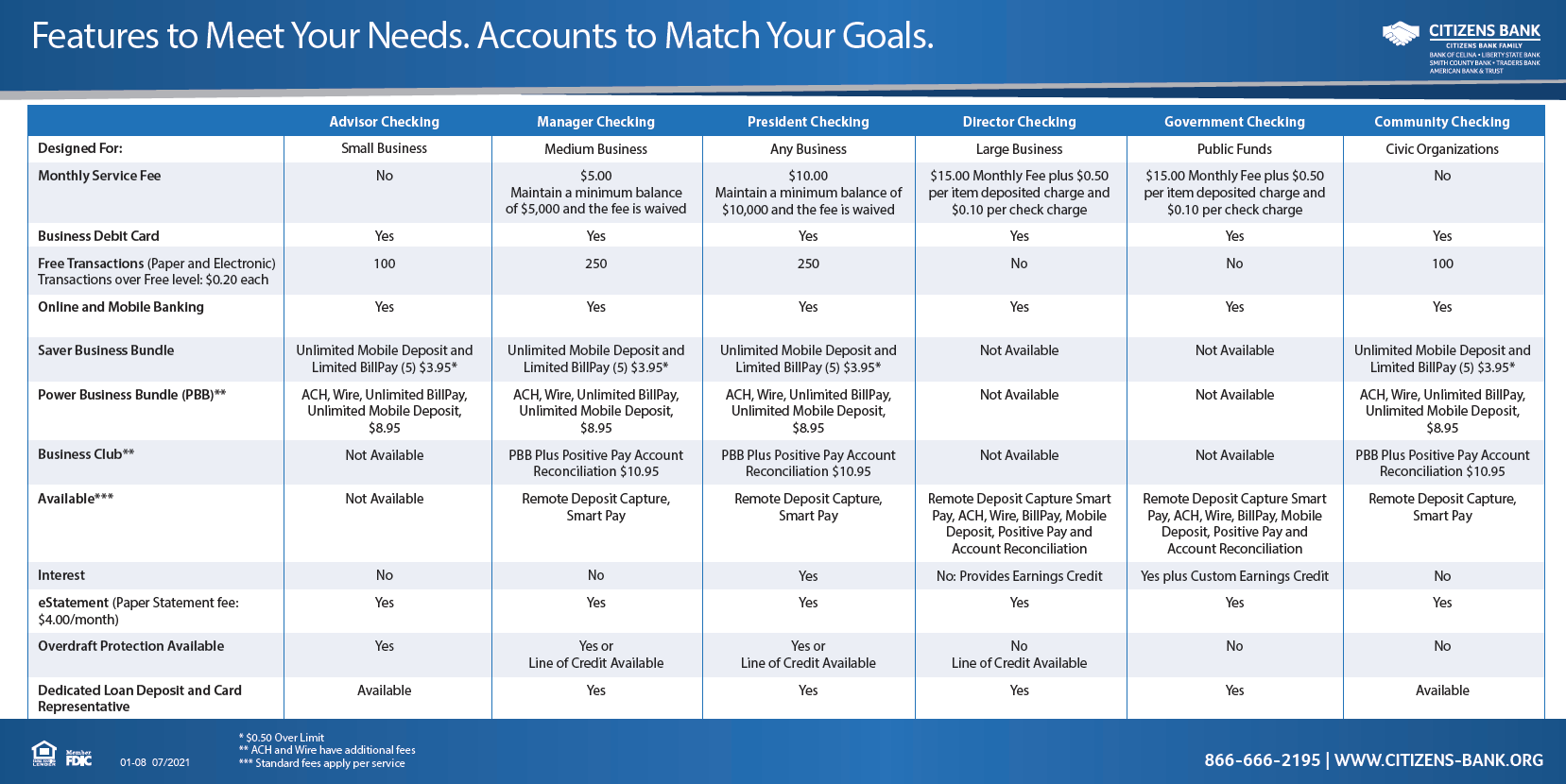

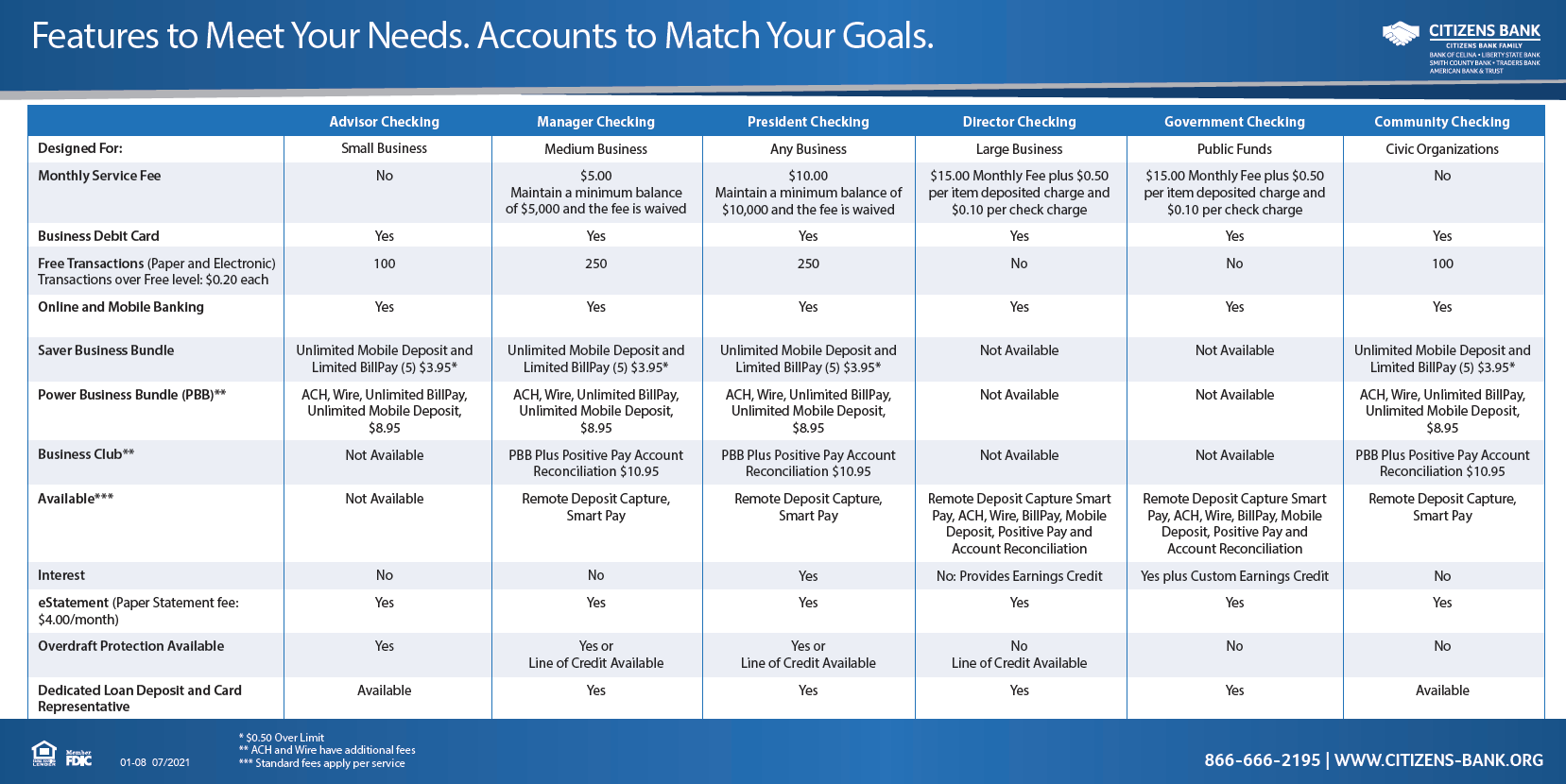

Advisor Checking

Our Advisor Checking account is designed specifically for business with lower transaction activity - plus, it give you all the features and benefits of a commercial checking account without the expense.

- Business Debit Mastercard1

- Online Banking

- Get 100 combined paper and electronic transactions2

- Mobile Banking

- 24/7 on-demand eStatement3

- Overdraft Privilege Protection available

- No Monthly Service Fee

- Bundle Options available

- Only $25 Deposit to Open

View more information about our Advisor Checking here.

Think Medium Business with...

Think Medium Business with...

Manager Checking

Our Manager Checking account is specifically for businesses with moderate transaction activity. This account includes more included transactions than our Advisor account and a dedicated loan, deposit and cards services representative.

- Business Debit Mastercard1

- Online Banking

- Get 250 combined paper and electronic transactions2

- Dedicated Loan and Deposit Specialist

- Card Services Representative

- Mobile Banking

- 24/7 on-demand eStatement3

- Overdraft Privilege Protection available

- Lines of Credit available

- Minimum balance of $5,000 to avoid monthly service fee of $5.00

- Bundle Options available

- Only $25 Deposit to Open

View more information about our Manager Checking here.

Think Interest with...

Think Interest with...

President Checking

If you have a higher volume of transactions and are looking for interest, our President Checking account is the best option. This account includes all the transactions and a dedicated loan, deposit and card services representative as our Manager Checking with the interest!

- Business Debit Mastercard1

- Online Banking

- Get 250 combined paper and electronic transactions2

- Dedicated Loan and Deposit Specialist

- Card Services Representative

- Mobile Banking

- 24/7 on-demand eStatement3

- Overdraft Privilege Protection available

- Lines of Credit available

- Minimum balance of $10,000 to avoid monthly service fee of $10.00

- Pays Interest

- Bundle Options available

- Only $25 Deposit to Open

View more information about our President Checking here.

Think Large Business with...

Think Large Business with...

Director Checking

If your business has a higher volume of transactions, our Director Checking account allows you to offset monthly fees with an earnings credit on balances kept in your account. This account includes a dedicated loan, deposit and card services representative.

- Business Debit Mastercard1

- Online Banking

- Dedicated Loan and Deposit Specialist

- Card Services Representative

- Mobile Banking

- 24/7 on-demand eStatement3

- Lines of Credit available

- Analysis of Charges with an Earnings Credit

- $15.00 Monthly Service Fee plus $0.05 per item deposited charge and $0.10 per check charge.

- Cash Management Solutions available

- Only $25 Deposit to Open

Call or visit your nearest branch and let us customize a Director Checking account that suits your needs.

View more information about our Director Checking here.

Think Public Entities with...

Think Public Entities with...

Government Checking

If your city, county, or state agency has a higher volume of transactions, our Government Checking account allows you to offset monthly fees with an earnings credit on balances kept in your account. This account includes a dedicated business representative to help you navigate the right services to fit your needs.

- Business Debit Mastercard1

- Online Banking

- Business Service Representative

- Mobile Banking

- 24/7 on-demand eStatement3

- Analysis of Charges with an Earnings Credit

- $15.00 Monthly Service Fee plus $0.05 per item deposited charge and $0.10 per check charge.

- Cash Management Solutions available

- Only $25 Deposit to Open

Call or visit your nearest branch and let us customize a Government Checking account that suits your needs.

View more information about our Government Checking here.

Think Civic Organizations with...

Think Civic Organizations with...

Community Checking

Our Community Checking account is designed specifically for community organizations like clubs, teams and other non-profit organizations who have lower transaction activity - plus, it gives you all the features and benefits of a commercial checking account without the expense.

- Business Debit Mastercard1

- Online Banking

- Get 100 combined paper and electronic transactions2

- Mobile Banking

- 24/7 on-demand eStatement3

- No Monthly Service Fee

- Bundle Options available

- Only $25 Deposit to Open

View more information about our Community Checking here.

Add These Business Services with...

Add These Business Services with...

Bundle Options

Speed up your business with an additional bundle option. The following bundle options are available for business accounts:

SAVER BUSINESS BUNDLE - $3.95 Per Month

- Unlimited Mobile Deposit - Mobile check deposit allows you to save time by depositing your checks remotely, no matter where you are or what time of day it is. Instead of making a run to the bank, you can simply snap a picture of the front and back of the check on your smartphone and deposit it using the bank's mobile app.

- Limited BillPay4 - Pay your business bills quickly and easily online. Simplify your accounts payable. Vendors receive a bank deposit or check in the mail. Five BillPay transactions allowed per month.

POWER BUSINESS BUNDLE - $8.95 Per Month

- ACH5 - Fast, secure automated clearing house (ACH) payment solutions so you can more easily manage payroll, vendor payments, and more.

- Wire5 - Move money fast so you can get back to business. Our wire transfer services help you quickly move funds across the country or around the world.

- Unlimited BillPay - Same as the Saver Business Bundle, but Unlimited!

- Unlimited Mobile Deposit - Same as the Saver Business Bundle.

BUSINESS CLUB - $10.95 Per Month

- Includes all the features of the Power Business Bundle plus...

- Positive Pay - Positive Pay detects fraudulent checks at the point of presentation and prevents them from being paid.

- Account Reconciliation - Provides us with a file of checks issued and we will reconcile your payments to your account.

See a bank representative for our Business Fee Schedule.

- Replacement card fee may apply. See bank for details.

- Fee for transactions over 100, $0.20 per transaction.

- Paper statement fee $4.00 per month.

- $0.50 fee per BillPay transaction over 5 per month.

- ACH and Wire transaction fee apply, see business fee schedule above for more information.

Think Small Business with...

Think Small Business with... Think Medium Business with...

Think Medium Business with... Think Interest with...

Think Interest with... Think Large Business with...

Think Large Business with... Think Public Entities with...

Think Public Entities with... Think Civic Organizations with...

Think Civic Organizations with... Add These Business Services with...

Add These Business Services with...