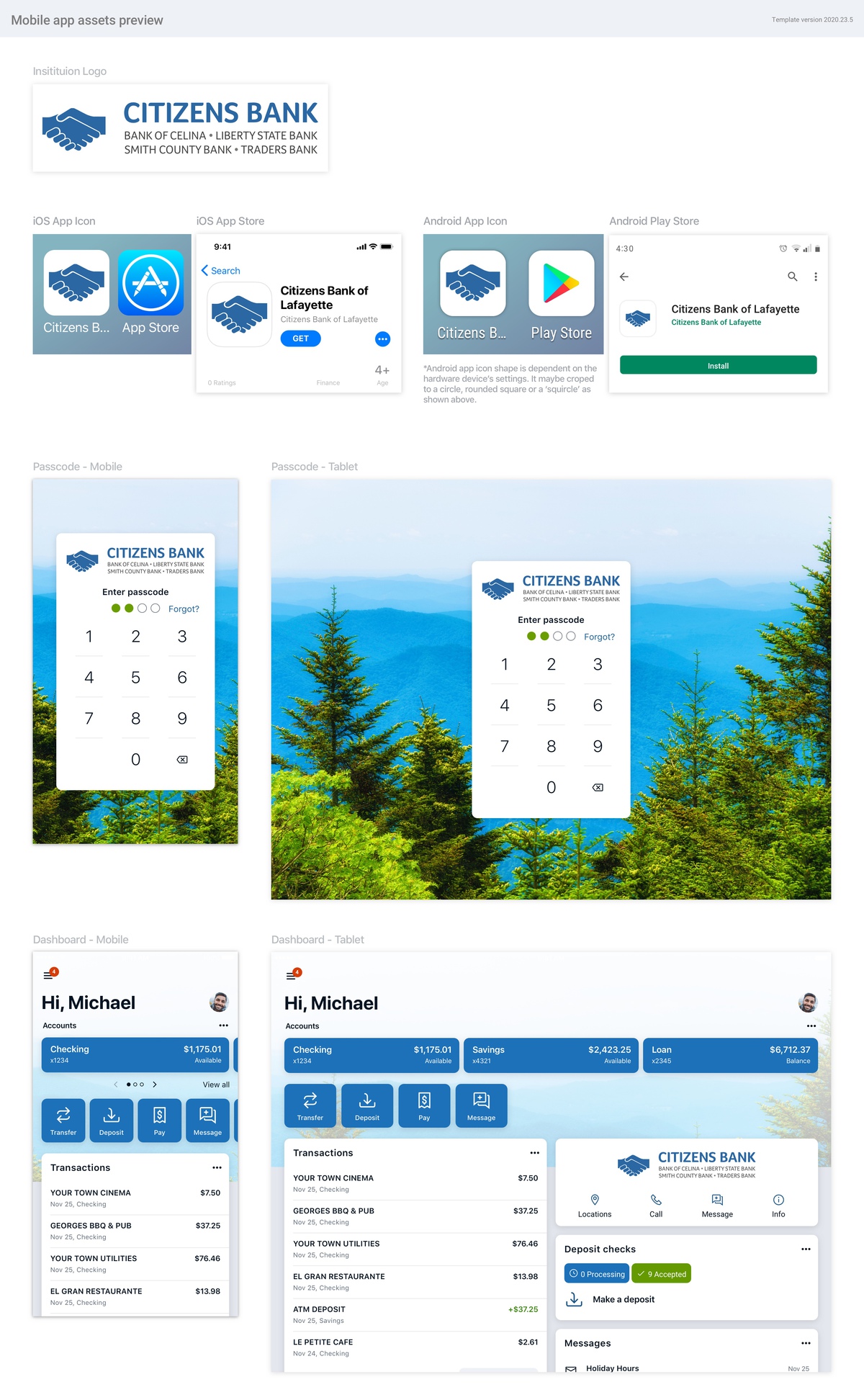

Get ready for speed and convenience at your fingertips. With several different ways to bank, you now have your own personal Citizens Bank branch in the palm of your hands.

Get ready for speed and convenience at your fingertips. With several different ways to bank, you now have your own personal Citizens Bank branch in the palm of your hands.

Compare the different mobile options and choose what is right for you!

| Mobile App | Mobile Web | Text Banking | |

|---|---|---|---|

| Free! Carrier Data Charges May Apply |

|

|

|

| Account Activity |  |

|

|

| Transfers between eligible Citizens Bank Accounts |

|

|

|

|

Bill Pay and P2P (person to person)

payments

|

|

|

|

| Mobile Deposit with the camera feature on your device |

|

||

| Locations of branches and free ATM's near you |

|

|

|

| Help |  |

|

|

| Security including device authentication and auto-signoff |

|

|

|

Please review our "Mobile Banking Agreement and Specific Disclosure"* below.

* Printable version of the Mobile Banking Agreement and Specific Disclosure.

MOBILE BANKING AGREEMENT AND SPECIFIC DISCLOSURE INFORMATION REQUIRED BY FEDERAL LAW

As used in this agreement for Mobile Banking services, the following words are defined as shown below:

• Account(s) means your eligible Citizens Bank checking, savings, loan, or other Citizens Bank products that may be accessed through Mobile Banking.

• Agreement means this Mobile Banking Agreement And Specific Disclosure Information Required By Federal Law.

• Device means a supportable mobile device, including a cellular phone or other mobile device that is web-enabled and allows secure SSL traffic, which is also capable of receiving text messages. Please consult your wireless provider to determine whether you will be charged fees for data or text messaging services.

• Mobile Banking means the banking services accessible by you from the Device you have registered with us.

• You, Your, or Customer means each person authorized to access your account(s)using the Mobile Banking service.

• We, Us, Our, or the Bank means Citizens Bank.

To initiate Mobile Banking,please read this Agreement carefully and then click the "I Agree" button at the bottom. When you click the“I Agree” button, you agree to the terms and conditions of this Agreement and acknowledge its receipt and your understanding of its terms. Any other persons you have authorized to use Mobile Banking are equally bound to the terms and conditions of this Agreement.

YOUR SECRET CODE TO ACCESS TO YOUR ACCOUNTS VIA MOBILE BANKING

Your secret code (PIN) will give you access to your accounts via Mobile Banking. For security purposes, it is recommended that you memorize your secret code and do not write it down. We also recommend that you change your secret code regularly to avoid misappropriation by a third party. You are responsible for keeping your secret code and account data confidential. When you give someone your secret code, you are authorizing that person to use Mobile Banking and on-line financial services and you are responsible for all transactions performed using your secret code.

CONTACTING US

If you wish to contact us through Mobile Banking, we do not recommend you use conventional e-mail, which may not be a secure method of contacting us over the Internet. Instead, we suggest you contact us through the Online banking section of our website that is a secure method of communication.

USE OF MOBILE BANKING

You agree to the following by enrolling for Mobile Banking or by using Mobile Banking services:

• You may not gain, or attempt to gain, access to any Mobile Banking and/or related server, network, or data not specifically permitted to you, and you must not include any obscene, libelous, scandalous or defamatory content in any communications.

• We are not responsible for any electronic virus that you may encounter using Mobile Banking. We encourage you to use a reliable virus protection product to detect and remove viruses. We do not endorse products or services offered by any company or person linked to Mobile Banking nor are we responsible for any software or the content of any information published on the website of any third party. You should take precautions when downloading files from websites to protect your Device and data from viruses and other destructive programs.

• We may assign our rights and/or delegate all or a portion of our duties under this Agreement to a third party. We may also assign or delegate certain rights and responsibilities under this Agreement to independent contractors or other third parties. You may not assign this Agreement to any other party.

• We shall not be responsible for any attempted use of Mobile Banking on equipment or for transaction errors or failure resulting from the malfunction or failure of the Device or peripheral equipment you use. In no event shall we be liable for any loss, damage or injury from whatever cause, nor shall we be liable for any direct, indirect, special or consequential damages arising from or connected in any way with the use or maintenance of the Device or peripheral equipment you use.

• You agree not to leave your Device unattended while logged into Mobile Banking and to log off immediately at the completion of each access by you. You agree not to provide your username,password or other access information to any unauthorized person.

• We reserve the right to terminate this Agreement or to change the charges, fees or other terms described in this Agreement at any time. When changes are made, we will notify you either by: (1) electronic mail if you have agreed to receive communication electronically or (2) physical mail at the address shown in our records. You agree to promptly notify us of any change to your address.

• The Bank reserves the right to terminate your use of Mobile Banking at anytime. We will attempt to notify you in advance we if terminate your use of Mobile Banking, but we are not obligated to notify you in advance.

• If there is a conflict between the terms and conditions of this Agreement and one or more terms contained in another agreement between you and us, this Agreement will control as it is applicable to Mobile Banking.

• We reserve the right to decline any transaction that we believe is an illegal transaction or a high-risk transaction in any applicable jurisdiction. You agree not to use the Services to engage in any internet or online gambling transaction, whether or not gambling is legal in any applicable jurisdiction. We reserve the right to decline any transaction that we believe is an internet or online gambling transaction. You further agree that we are not responsible for the recovery or reimbursement to you of any funds transferred in connection with any transaction authorized by you that is determined to be illegal. You certify that you have legal capacity to enter into this Agreement under applicable law.

• There are types of payments that may be prohibited through Mobile Banking or by Federal or applicable law. These payments include but are not limited to (of which we may, but may not be required to, monitor, block, or reverse):

• Payments that violate any law, statute,ordinance or regulation.

• Payments to or from persons or entities located outside of the United States and its territories; and

• Payments related to activities such as:

- taxes or court-directed payments;

- terrorism or terrorist financing;

- money-laundering;

- controlled substances;

- assisting in illegal activity;

- gambling;

- illegal sexually-oriented products;

- the promotion of hate, violence, defamation, offensiveness, obscenity, indecency, vulgarity, or harassment;

- schemes (such as pyramiding, ponzi, exploitation, credit repair, stored-value/check cashing/currency exchanging);

- infringement of copyrights, patents, trademarks, trade secrets or other proprietary rights or rights of privacy;

- the sale of counterfeit or stolen items, including but not limited to, use of Mobile Banking to impersonate another person or entity;

- interference with or disrupt the use of MobileBanking by any other user;

- use of Mobile Banking in such a manner as to gain unauthorized entry or access to the computer systems of others; or -interfering with or disrupting computer networks connected to Mobile Banking.

MOBILE BANKING - REMOTE DEPOSIT CAPTURE

You may use Mobile Banking to make deposits into your eligible deposit accounts using your Device and a software application, scanning an image of original paper checks that are drawn on or payable through United States financial institutions and electronically submitting the paper check images and deposit information to us for deposit into eligible account(s) for collection by us. You may only scan checks payable to you, properly endorsed by you, drawn on United States financial institutions, and contain a valid routing number. This process is termed the “Remote Deposit Capture“ service.

The Remote Deposit Capture service requires our approval. We may at our discretion change, suspend or discontinue the Remote Deposit Capture service, in whole or in part, or terminate your use of the Remote Deposit Capture service at any time, in whole or in part, without prior notice to you. We are not responsible for any third party software you use for the Remote Deposit Capture service. We reserve the right to change hardware and software requirements; we will notify you of any material change by e-mail or on our Online Banking website. You may terminate the Remote Deposit Capture service. In the event of termination of the Remote Deposit Capture service, you will remain liable for all transactions performed on your account.

You may scan and submit check images for deposit to us within dollar limits established for you by us. We reserve the right to limit the frequency and dollar amount of deposits submitted through the Remote Deposit Capture service. If you exceed the limits established for you by us, it is our discretion to accept or refuse the check image(s) deposited. If we accept a check image deposit that exceeds your deposit limits, we have no obligation to do so in the future. We at any time may or lower your deposit limits at our discretion. The service is limited to $1,500.00 per day.

A check image submitted to us electronically for deposit is not deemed received until Citizens Bank accepts, processes, and confirms receipt of your check image deposit. We only accept and process electronically received check images during our regular business days and hours. For purposes of the Remote Deposit Capture service regarding the receipt and processing of electronically submitted check images, our Business Days are Monday through Friday, from 8:00 am CST to 4:00 pm CST, excluding bank holidays. Check images deposit received after this time or on Saturdays, Sundays, and holidays when we are closed will be processed on our next Business Day. We will send you an email to confirm receipt of your check image deposit or if it is rejected. The Remote Deposit Capture service is conditioned upon the availability of the wireless or computer services and systems used in transmitting your requests and our response. You agree that we shall not be liable or responsible for any loss or damage incurred due to the failure or interruption of the Remote Deposit Capture service, wireless or computer services, or systems, resulting from the act or omission of any third party or other causes not within our control. In the event the Remote Deposit Capture service is unavailable, you acknowledge you may deposit original check(s) at our branches, through our ATMs if the ATM has a deposit-taking function, or by mailing original check(s) to Citizens Bank, Deposit Operations, P.O. Box 100, Lafayette, TN 37083.

In some instances we may not be able to receive check images. You agree that we are not obligated to accept for deposit any check images that we have determined to be ineligible for the Remote Deposit Capture service. These instances may occur, for instance but not limited to, when:

The checks are not payable to you;

The check images are illegible;

The checks are not drawn on United States banks;

The check images have been previously been converted electronically (termed “substitute checks” as defined by Check 21);

The check images and quality are unreadable (including MICR data);

The original check is dated more than six months prior to the date of deposit;

The checks are post-dated;

There is evidence of alteration to the information on the check(s);

The checks are ones in which a stop payment order has been issued;

The checks are fraudulent or otherwise not authorized;

The checks lack an endorsement;

The check have been re-deposited or returned for“non-sufficient funds;”

The checks are ones on which there are insufficient funds;

The check image does not comply with the requirements established by the American National Standards Institute (“ANSI”), the Board Of Governors Of The Federal Reserve Board, under federal Regulation CC, or any other regulatory agency, clearing house or association, or

The checks or actions do not comport with any other provisions(s) of this Agreement.

You understand, in the event you receive a notification from us confirming receipt of an image, such notification does not mean the image contains no errors or we are responsible for any information you transmit to us. Ineligible deposits may result in an immediate reversal of credit to your account, as well as termination of the Remote Deposit Capture service. A reversal might result in a negative balance to your account. You agree that even if we do not identify a check image as ineligible, the check image may be returned to us because the check image is considered ineligible by the financial institution upon which it is drawn or by an intermediate collecting financial institution. You agree that even if we do not initially reject a check image you submit through the Remote Deposit Capture service, we may ask you to provide the original check, because, for example, a paying bank may reject the electronic image as ineligible. We are not liable for any fees, service, or late charges charged against you due to a rejection of any check image. You are responsible for any loss or overdraft plus any applicable fees to your account due to a check image returned by us or a third party.

You agree to deposit only“checks” as that term is defined in Consumer Financial Protection Bureau Regulation CC. The check images received and processed for deposit through the Remote Deposit Capture service will be treated as “deposits” under your general account Agreement. If not rejected or returned as ineligible, your availability of funds deposited via the Remote Deposit Capture service using check images may vary at our discretion and generally be available according to our Funds Availability Policy as provided to you (please contact us (615) 666-7262 or (866) 666-2195 (toll free) or write us Citizens Bank,Deposit Operations, P. O. Box 100, Lafayette, TN 37083 if you would like us to provide you another copy of Funds Availability Policy.

If you transmit check images to us, you agree to retain the original check for a period of at least 30 days. You agree to store the check securely in which only you or persons you have authorized have access to the checks, and the checks cannot be deposited nor scanned and transmitted through another Remote Deposit Capture service. You agree to destroy the original check after 30 days using a paper shredder. You agree to furnish us the original check upon request. If were quest, you must provide us any checks requested during this 30-day period.

You agree that you will not deposit the original check with us or any other entity, including through another Remote Deposit Capture service, if the original check has already been submitted and accepted for deposit into your account with us.

You shall indemnify, defend, and hold Citizens Bank and its officers, employees, directors, suppliers and agents from and against all liability, damage and loss arising from any claims, suits, or demands, brought by third parties with respect to any check image, Substitute Check, or original check processed through the Remote Deposit Capture service as described above.

You agree your use of the Remote Deposit Capture service at your risk and is provided on an "as is" and "as available" basis. There are no warranties of any kind as to the use of the Remote Deposit Capture service. We make no warranty that the Remote Deposit Capture service (1) will be uninterrupted, timely, secure, or error free, (2) any errors in the services or technology will be corrected, or (3) the Remote Deposit Capture service will meet your needs. In no event will we be liable to you for any incidental or indirect damage arising out of the use, misuse or inability to use the Remote Deposit Capture service or for any loss of data.

SEVERABILITY

If any term, portion, or provision of this Agreement is determined to be illegal or invalid (or incapable of being enforced by any regulations, laws, or a court of law), such in validation of such term, portion, or provision of this Agreement does not invalidate the remaining term, portion, or provision of this Agreement and it shall remain in full force and effect. Upon a determination that any term, portion, or provision is illegal or invalid (or incapable of being enforced), you and Citizens Bank agree in good faith to modify this Agreement so as to affect the original intent of the parties to closely expressing the original intention of the invalid or unenforceable term or provision.

If there is a conflict between the terms and conditions of this Agreement and one or more terms contained in another agreement between you and us, this Agreement will control as it pertains to Mobile Banking.

INDEMNIFICATION

You agree that you will not hold us liable for any for any loss nor damages resulting from a receiver’s or payee’s decision to accept or not to accept a payment made through the Mobile Service.

The Bank shall not be liable for any loss nor damage due to causes beyond its control, including fire,explosion, lightning, pest damage, power surges or failures, strikes or labor disputes, water, acts of God, the elements, war, civil disturbances, acts of civil or military authorities or the public enemy, inability to secure raw materials, transportation facilities, fuel or energy shortages, acts or omissions of communications carriers, or other causes beyond the Bank’s control.

You agree to indemnify and hold harmless the Bank and its officers, employees, directors, suppliers and agents,in their individual capacities or otherwise, from and against any losses arising out of: (i) Customer’s negligence; (ii) Customer’s failure to comply with applicable law; or (iii) Customer’s failure to comply with the terms of this Agreement.

SPECIFIC DISCLOSURE INFORMATION REQUIRED BYFEDERAL LAW

The following disclosures are provided to you in accordance with federal law.

SERVICES

Through Mobile Banking, you can manage eligible accounts from your Device. Mobile Banking can be used to conduct any of the following on-line financial transactions using your Device:

● Obtain balances and transaction histories on all eligible accounts including your checking, savings, and loan (accounts) enrolled in Mobile Banking (All account balances and transaction histories reflect activity through the close of the previous banking day);

● Transfer money between your checking and savings. (The number of transfers you can make from account is limited as described in the applicable account agreement.

In addition, if a hold is placed on any funds deposited in an eligible account, you may not transfer the portion of funds being held until that hold expires);

● Transfer money to pay us for overdraft protection, consumer loans, home equity loans, or certain other eligible loans;

● Transfer funds from your eligible accounts to United States merchants in payment for goods and/or services,

● Pay bills directly from your checking and savings accounts in the amounts and on the days you request.

● Perform account maintenance such as changing you secret code or other passwords,re-ordering checks, requesting check copies, requesting monthly statements copies, obtaining ATM or purchase receipts if activated and available through ATM or other networks, and changing your address and phone records.

● Receive account or security alerts from us regarding your account or activity on your account. You may suppress these alerts,although we highly recommend you maintain these alerts for receiving important information from us regarding Online banking and security.

● Make deposits into your deposit accounts by scanning an image of original paper checks and electronically submitting the paper check images to us for deposit(termed the “Remote Deposit Capture service”).

In addition to this Agreement,all transfers made by use of your Device and secret code are subject to the terms and conditions contained in the signature cards and the applicable customer agreement for your account or accounts. This Agreement is made as part of that customer agreement. We may, from time to time, introduce new online financial services. By using those services when they become available, you agree to be bound by the terms contained in this Agreement, and its subsequent amendments.

LIMITATIONS ON FREQUENCY AND DOLLAR AMOUNT OF TRANSFERS

Subject to your mobile service provider permitted transactions, transfers are limited regarding the following:

● Any account that requires two or more signatures to make withdrawals, transfers or other transactions is not eligible for Mobile Banking.

● Transfers and bill payments are limited up to a daily limit based on the available balance in your accounts.

● Transfers from a money market deposit account or a savings account to another account or to third parties by pre-authorized, automatic, or telephone transfer are limited to six per month (including by check, debit card, or similar order to third parties).

The minimum amount of a payment is $5.00 and the maximum payment amount of $1,500.00. Payments entered before 2:00 pm Monday through Friday will be processed that day. Payments made after 2:00 pm Monday thru Friday or on the weekends will be processed on the next business day. Payments will be sent either electronically or by check dependent on the payee's ability to receive an electronic payment or by check. Payments must be sent in adequate advance of the payees requested due date. You agree Citizens Bank is not liable for any service fees or late charges levied against you. You also agree that you are responsible for any loss or penalty that you may incur due to lack of sufficient funds.

There is a limit of $ 1,500.00 per day for the Remote Deposit Capture service.

FEES

● Citizens Bank will charge a fee of $0.50 per each Remote Deposit Capture completed.

● Please refer to the applicable customer agreement and fee schedule for fees associated with your account(s).

● You may be charged fees by your mobile service or telephone provider, of which you should refer to your applicable agreements with or contact your mobile service or telephone provider. You are responsible for any and all telephone access fees and/or Internet service fees that may be assessed by your Device.

Any fees incurred will be deducted from the account you have designated. Please see our latest fee schedule for our returned item fee or overdraft fee if incurred.

When you use an ATM not owned by us, you may be charged a fee by the ATM operator or any network used (and you may be charged a fee for a balance inquiry even if you do not complete a fund transfer).

SUMMARY OF YOUR LIABILITY FOR UNAUTHORIZED ELECTRONIC FUND TRANSFERTRANSACTIONS

Tell us AT ONCE if you believe your Device or secret code has been lost or stolen, or if you believe that an electronic fund transfer has been made without your permission using information from your check. Telephoning is the best way of keeping your possible losses down. You could lose all the money in your account (plus your maximum overdraft line of credit). If you tell us within 2 business days after you learn of the loss or theft of your Device or secret code, you can lose no more than $50 if someone used your Device or secret code without your permission.

If you do NOT tell us within 2 business days after you learn of the loss or theft of your Device or secret code, and we can prove we could have stopped someone from using your Device or secret code without your permission if you had told us, you could lose as much as $500.

Also, if your statement shows transfers that you did not make, including those made by the Device, secret code or other means, tell us at once. If you do not tell us within 60 days after the statement was mailed to you, you may not get back any money you lost after the 60 days if we can prove that we could have stopped someone from taking the money if you had told us intime. If a good reason (such as a long trip or a hospital stay) kept you from telling us, we will extend the time periods.

CONTACT IN EVENT OF UNAUTHORIZED TRANSFER

If you believe your Device or secret code has been lost or stolen, call: (615) 666-7262 or (866) 666-2195(toll free) or write: Citizens Bank, c/o Electronic Banking, P. O. Box 100,Lafayette, TN 37083.

You should also call the number or write to the address listed above if you believe a transfer has been made using the information from your account without your permission.

BUSINESS DAYS

Mobile Banking is generally available 24 hours a day, 7 days a week, except during system maintenance and upgrades. However, we only process transactions and update information on business days. Our business days are Monday through Friday. Transfers made after 3:30 pm will be processed on the next business day. Transfers made after 3:30 pm on Friday (thru weekend) will be processed on Monday. Holidays are not included.

You may call us regarding questions about Online Banking Services Monday through Thursday from 8:00 am to4:00 pm, Friday 8:00 am to 5:00 pm, and Saturday from 8:00 am to 12:00 pm,excluding bank holidays. You may also write us at: Citizens Bank, c/o Electronic Banking, P O Box 100, Lafayette, TN 37083.

For purposes of Remote Deposit Capture service regarding the receipt and processing of electronically submitted check images, our business days are Monday through Friday, from 8:00 am CST to 4:00 pm CST, excluding bank holidays.

(You can usually access on-line financial services seven (7) days a week, twenty-four (24) hours a day. However, at certain times, some or all of Mobile Banking or on-line financial services may not be available due to system maintenance or reasons beyond our control. We do not warrant that Mobile Banking or on-line financial Services will be available at all times. When unavailable, you may use our telephone banking system, an automated teller machine (“ATM”), or one of our branch offices to conduct your transactions.)

SUMMARY OF YOUR RIGHT TO RECEIVE DOCUMENTATION OF TRANSFERS

(A) Terminal Transfers. You can get a receipt at the time you make any transfer to or from your account using one of our automated teller machines or point-of-sale terminals. For purchases and cash advances using your Mobile Banking, you will get a confirmation from the merchant or financial institution for each transaction.

(B) Preauthorized Credits. If you have arranged to have direct deposits made to your account at least once every 60 days from the same person or company, you can call

us at (615) 666-7262 or (866)666-2195 (toll free) to find out whether or not the deposit has been made. You will get a monthly account statement (unless there are no transfers in a particular month or if the only possible transfers are direct deposits. In any case you will get the statement at least quarterly.)

(C) Periodic Statements. You will get a monthly account statement concerning your checking account and a monthly account statement covering your savings account unless there are no transfers in a particular month to or from your savings account. In any case, you will get the statement covering your savings account at least quarterly.

RIGHT TO STOP-PAYMENT AND PROCEDURE FOR DOING SO

(A) You cannot stop any transfer between accounts using Mobile Banking.

(B) If you have told us in advance to make regular payments out of your account, you can stop any of these payments. Here is how: Call us at (615) 666-7262 or (866) 6662195 (toll free) or write us at Citizens Bank, c/o Electronic Banking, P. O. Box 100, Lafayette, TN 37083, or by using any electronic stop-payment method above which we have provided above for this purpose in our Online Banking service. You must contact us in time for us to receive your request three business days or more before the payment is scheduled to be made. If you call, we may also require you to put your request in writing and get it to us within 14 days after you call.

(C) Notice of Varying Amounts. If these regular payments may vary in amount,the person you are going to pay will tell you, 10 days before each payment, when it will be made and how much it will be. (You may choose instead to get this notice only when the payment would differ by more than a certain amount from the previous payment, or when the amount would fall outside certain limits that you set.)

(D) Liability For Failure To Stop-payment Of Preauthorized Transfers. If you order us to stop one of these payments three business days or more before the transfer is scheduled, and we do not do so, we will be liable for your losses or damages.

You will be charged $26.00 for any stop-payment order you give.

LIABILITY FOR FAILURE TO STOP-PAYMENT OFPREAUTHORIZED TRANSFER

If you order us to stop one of these payments 3 business days or more before the transfer is scheduled, and we do not do so, we will be liable for your losses or damages.

SUMMARY OF OUR LIABILITY FOR FAILURE TO MAKE TRANSFERS

If we do not complete a transfer to or from your account on time or in the correct amount according to our agreement with you, we will be liable for your losses or damages as provided by federal law. However, there are some exceptions. We will not be liable, for instance:

(1) If, through no fault of ours, you do not have enough money in your account to make the transfer.

(2) If the transfer would go over the credit limit on your overdraft line.

(3) If the automated teller machine where you are making the transfer does not have enough cash.

(4) If the system was not working properly and you knew about the breakdown when you started the transfer.

(5) If circumstances beyond our control (such as fire, flood, network or system down time, improper transmission or handling by a third party) prevent the transfer, despite reasonable precautions that we have taken.

(6) If the funds in your accounts are subject to a court order or other restriction preventing the transfer.

(7) If a merchant or financial institution fails to accept the Device, code, or its instructions

(8) If you have not provided the correct information, including but not limited to the correct account information, or the correct name and address or phone number of the receiver to whom you are sending a payment;

(9) If you, or anyone you allow, commits fraud or violates any law or regulation;

(10) If your account is closed or has been frozen; and/or

(11) There may be other exceptions stated in our agreement with you.

If we are unable to complete the transaction for any reason associated with your account(s) (for example, you do not have enough money in your account to make the transfer), the transaction may not be completed. In some instances,you may receive a return notice from us. In each such case, you agree that: (a) You will reimburse us immediately upon demand the transaction amount that has been returned to us and for any fees or costs we incur in attempting to collect the amount of the return from you.

DISCLOSURE OF ACCOUNT INFORMATION TO THIRD PARTIES

We will disclose information to third parties about your account or the transfers you make:

(1) Where itis necessary for completing transfers, or

(2) In order to verify the existence and condition of your account for a third party, such as a credit bureau or merchant, or

(3) In order to comply with government agency or court orders, or

(4) If you give us your written permission.

SUMMARY OF OUR ERROR RESOLUTION PROCEDURE

In case of errors or questions about your electronic transfers contact us immediately by writing, calling or emailing us at:

Citizens Bank

PO Box 100 Lafayette, TN 37083

c/o Electronic Banking

(615)666-7262, (866) 666-2195 (toll free)

ebanking@citizens-bank.org

as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer listed on the statement or receipt. We must hear from you no later than 60 days after we sent the FIRST statement on which the problem or error appeared.

(1) Tell us your name and account number (if any).

(2) Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information.

(3) Tell us the dollar amount of the suspected error.

If you tell us orally, we may require that you send us your complaint or question in writing within 10 business days.

We will determine whether an error occurred within 10 business days after we hear from you and will correct any error promptly. If we need more time, however, we may take up to 45 days to investigate your complaint or question. If we decide to do this, we will credit your account within 10 business days for the amount you think is in error, so that you will have the use of the money during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not credit your account.

We will tell you the results within three business days after completing our investigation. If we decide that there was no error, we will send you a written explanation. You may ask for copies of the documents that we used in our investigation.

Get Started.jpg)

Citizens Bank Mobile App

Manage your finances while guarding against fraud by using the latest version of the Card Valet app:

-

Turn your credit cards on and off

-

Establish transaction controls for dollar amount limits, merchant categories and geographic locations

-

Receive alerts when your credit card is used, approved or exceeds the transaction controls set by you

-

Stay informed of potential fraud with alerts on attempted and declined transactions

-

Get real-time balances for your accounts

Download directly to your iPhone, iPad, or Android phone from the stores below:

- Once you have downloaded your mobile app, log into your eBanking account and enter your cell phone carrier information under the options tab - settings, mobile settings.

- Then log into your smart-phone app and start using your personal branch!

Mobile Deposit

For Mobile Deposit, please visit the contact us page for approval!

Mobile Web

Our website will automatically scale down per device (smart phone, tablet, etc.). Just log into our website like you would on your PC and start banking!

PC / Mac Desktop

For Online Banking from your desktop, visit our eBanking Enrollment page. Click here for list of supported browsers.

Text Banking

Text only plan? Signup through eBanking on our home page!

24-Hour Telephone Banking

Our Telephone Banker service is available toll free at (800) 318-5540.

Offline Mode

On occasion, our system may experience limited connectivity. If this happens, you will still be able to view your eBanking account information such as balance, transactions, bill pay, and message center. Click here to view a sample of what "offline mode" looks like.

Online Banking Tutorials

Need help with navigating your Online Banking? Click below to see our tutorial videos.